Mechanism:

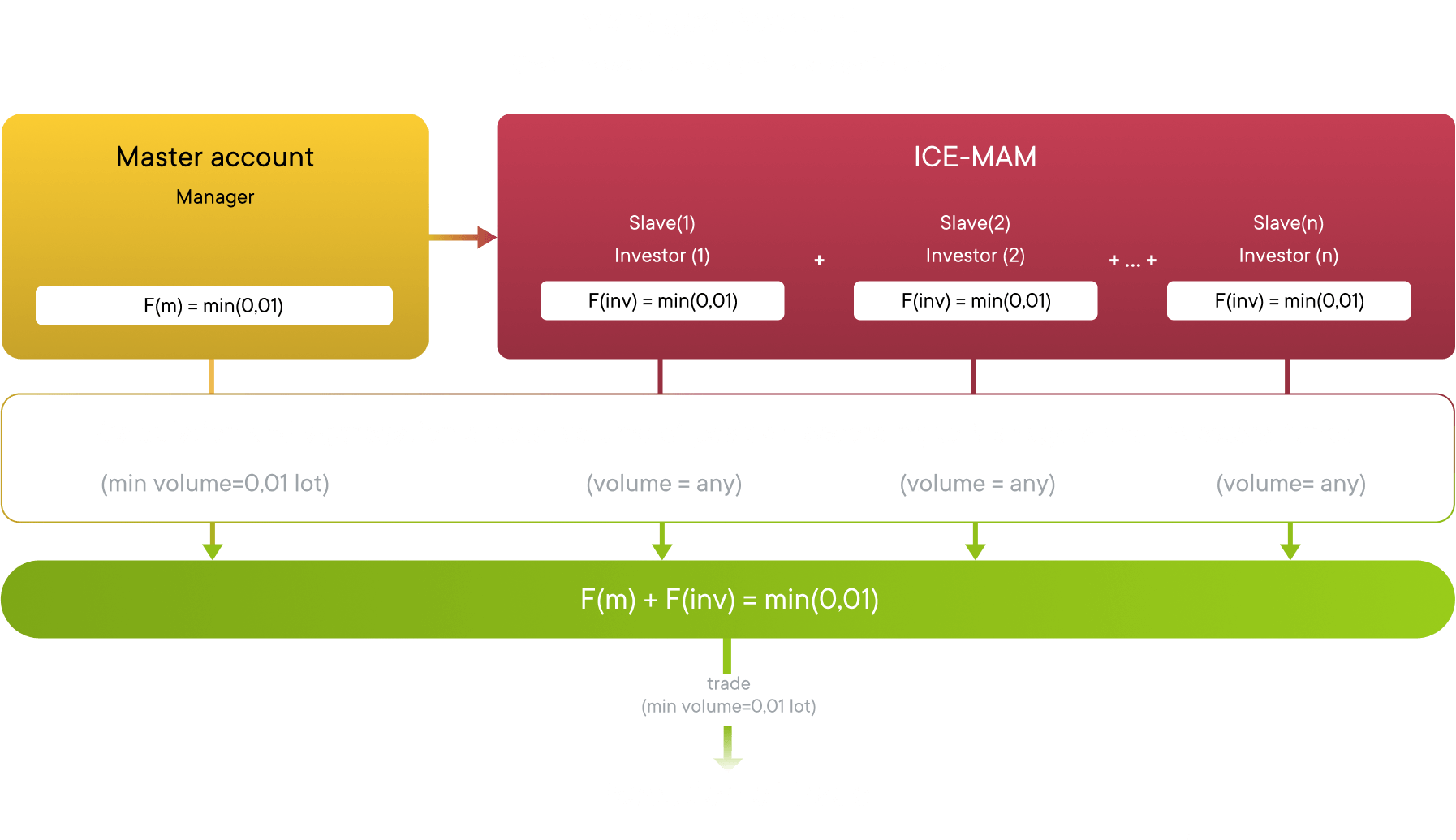

- For every Managed account an "Executive account" is created where the funds of the Manager and Investors are aggregated.

- The manager trades on the individual "Master account" and all its positions are copied to the "Executive account"

- All the positions of “Executive account” are sent to the external counterparties. As all the funds are aggregated on the “Executive account” it provides execution at single price and absence of difference in Manager`s and Investors` results. More ICE-MAM.

Comparison of the managed account system with the main investment technologies:

| PAMM | Copying services | MAM | MA System (ICE‑MAM) | |

|---|---|---|---|---|

| The manager's trading activity does not depend on the actions of investors and the trade auto-adjustment mechanism |

||||

| When investors' funds change, the manager does not need to correct the size of trades |

limited | |||

| The results of other investors are not affected by whether investors terminate their investment in the account or invest in it |

||||

| Order execution price is the same for the accounts of the manager and investors |

||||

| The accuracy of copying the manager's trades into investors' accounts does not depend on the investment amount |

||||

| The investor can instantly terminate his investment or invest in the account |

limited | |||

| General risk management settings | ||||

| Individual risk management settings | ||||

| The investor can invest in an account under open trades without causing any discrepancy between results |

limited | |||

| The investor can invest an amount that is less than the amount necessary to copy manager's trades that are not less than 0.01 lot in volume |

||||

| The investor can partially withdraw his funds under open trades without causing any discrepancy of results |

||||

| No discrepancies in investors' result, if it is impossible to – in the investor's account – open a position that is a multiple of 0.01 lot in size |

limited |

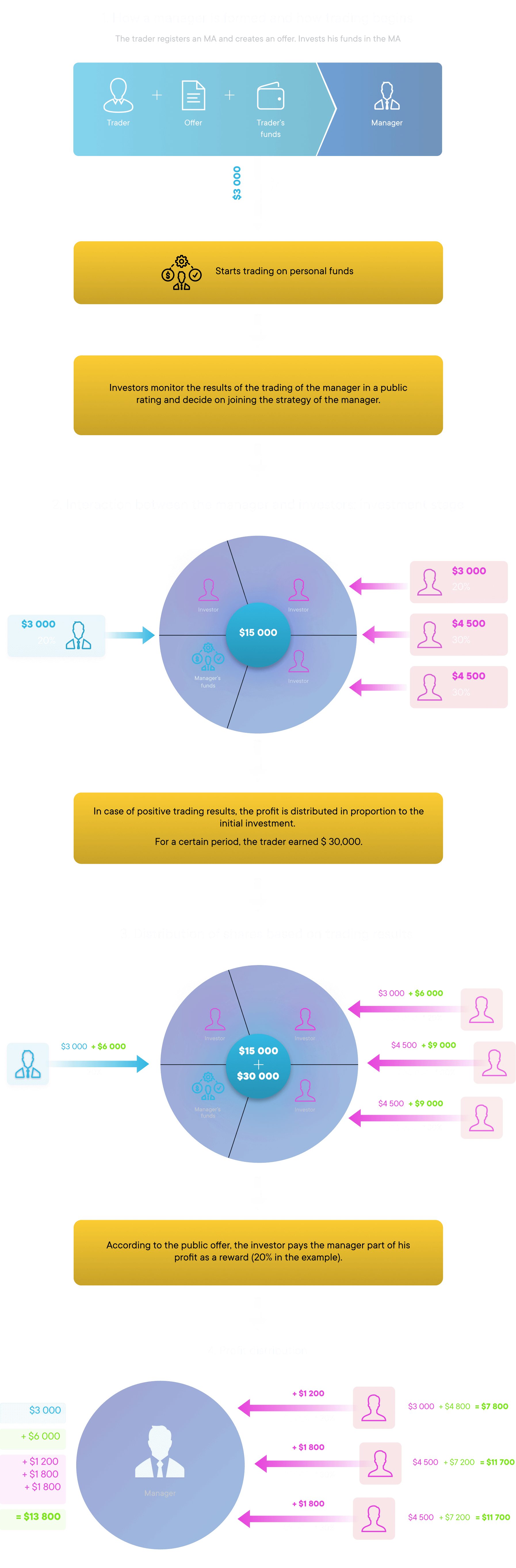

A managed account (MA) is a special type of account created to simplify the process of transferring investor's funds under trust management by a Forex trader (manager).

When investing in a managed account, the funds do not go directly to the manager's account, but are deposited in a general pool of all investors of that managed account. Or a personal investment account may be created for it. The manager's trades are copied to investors' accounts, while profit is distributed according to the managed account offer.

Deposit and withdrawal of funds

| Deposit | Withdrawal |

|---|---|

| At any time | At any time |

- An application is executed only during the open market period (00:05 ET Monday – 23:50 EET Friday).

Distribution of income and losses

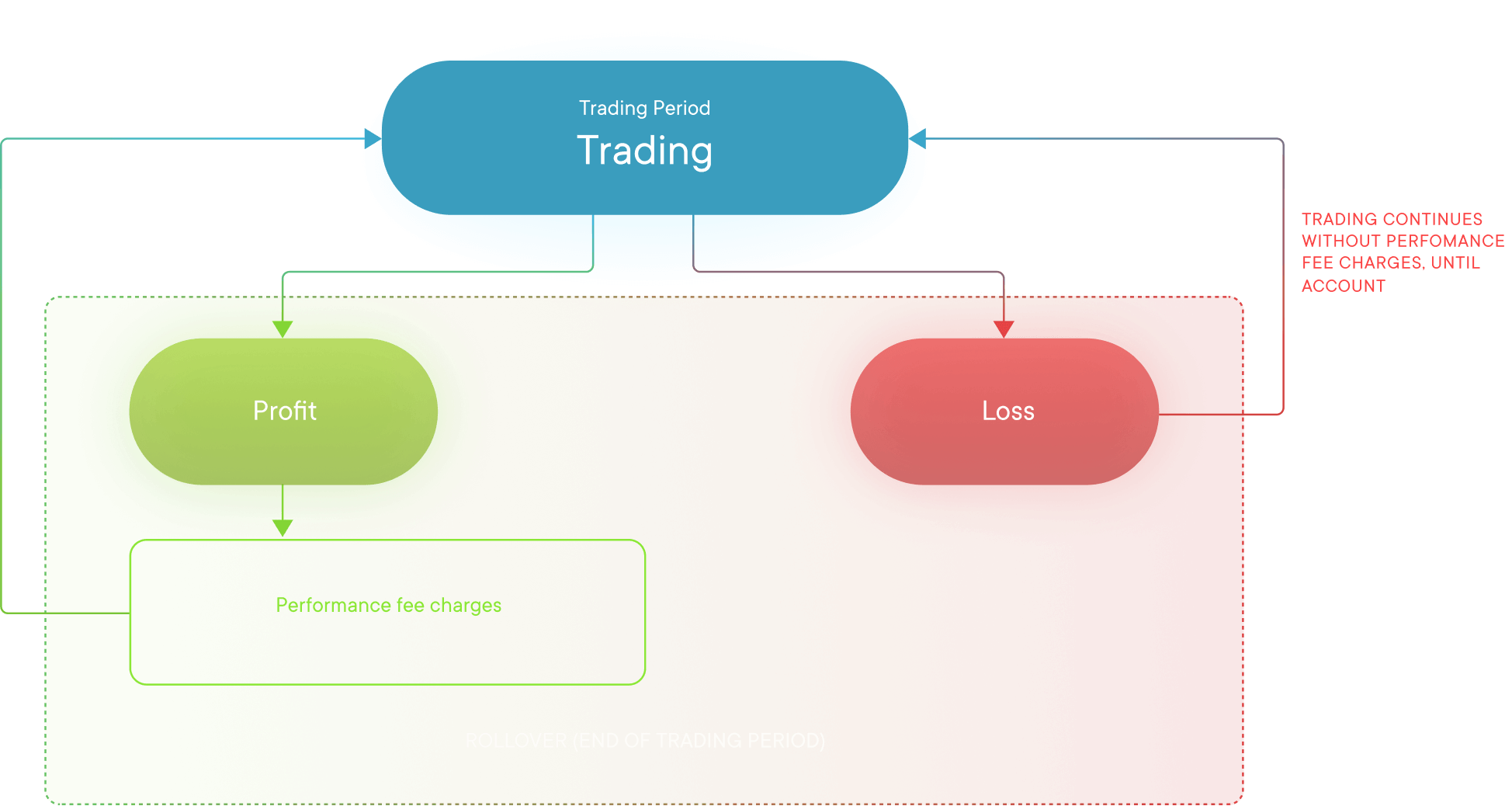

Profits and losses are distributed according to the classic High-Water Mark method. All calculations are based on the equity value of the account. The investor's trading result is calculated based on the account equity at the time investment was made or at the time the last profit was distributed (rollover). At the end of the trading period (or at the time the investor terminates his/her investment in the managed account), the financial results are calculated.

The account manager receives a performance fee only if his/her trading is profitable at the end of the trading period (or investment period).

The manager will receive no performance fee if the investor makes a loss at the end of the trading period. That manager will not receive any performance fee further until his trading compensates the investor's losses. Until then, the investor will continue to receive 100% of the profit.

Features

All calculations are based on the equity value of the account.

The current (at the time the investor invests in a managed account or terminates such investment) discrepancy between "balance" and "equity" due to the presence of open trades on the account does not affect the investor's funds and returns. The investor's result is not distorted both when investing in a managed account with open trades and when terminating such investment under open trades. The results of other investors of this account are also not distorted when there is a sharp change in the funds in this account.

The current (at the time the investor invests in a managed account or terminates such investment) discrepancy between "balance" and "equity" due to the presence of open trades on the account does not affect the investor's funds and returns. The investor's result is not distorted both when investing in a managed account with open trades and when terminating such investment under open trades. The results of other investors of this account are also not distorted when there is a sharp change in the funds in this account.

The investor's trading result is calculated based on the account equity at the time investment was made or at the time the last profit was distributed (monthly/quarterly rollover).

A trading month lasts from 00:05 EET of the 1st day of the current month to 00:05 EET of the 1st day of the next month.

The manager's results are summed up at the end of the trading month/quarter or when the investor terminates his/her investment in the managed account.

The manager receives performance fee only if his trading was profitable at the end of the trading period or at the time the investor left the account.

The manager receives no performance fee if the investor made a loss at the end of the trading period or at the time the investor left the account.

The manager receives no performance fee until his trading compensates the investor's losses. Until then, the investor will continue to receive 100% of the profit.

Benefits of a managed account

Master account

The manager trades on a separate account. This therefore makes his trading activity independent of investors' actions and the trade auto-adjustment mechanism. The trading activity of the manager of a managed account is completely identical to his trading activity on a personal trading account.

The manager's trading activity does not depend on whether investors terminate their investment in the account or invest in it.

The manager's trading activity does not depend on the trade auto-adjustment mechanism

The manager does not need to correct trades manually or refuse to correct volumes at all.

Auto Correction of Trade Volumes

Any movement of investors' funds does not distort account results, since trade volumes in investor accounts are automatically adjusted. Regardless of whether or not there are open trades at the time investors terminate their investment in the account or invest in it, the results for any investor depend only on what time that investor invested in the account, that is, from the moment the inventor deposited funds to the moment he/she withdrew all the funds.

An additional convenience for managers is that the trade auto-adjustment mechanism does not have any influence on their work due to the fact that the manager trades on a separate account (master account).

The manager does not need to correct the trading volume due to manual increase in investor funds.

Investment or termination of investment in an account does not distort results of the account for other investors.

When investing in an account under open trades, the trading result has an influence on the investor who invested in the account.

Execution at a single price

The trades of the master account and investment components are aggregated in the executive account before execution at counterparties. At the closing of the aggregated trade, the result is distributed between the manager and investors in proportion to the funds in the managed account.

This eliminates any possible discrepancy between the results of the manager and the investors.

Synchronization of results of open trades

If an account has open trades at the time of investing, the trades will be copied to the investor's account. In this case, the investor's results for these trades will be calculated based on the account equity at the beginning and end of investment. In most investment systems, investment under open trades leads to two possible outcomes: either there is discrepancy between the result of the account and the result of the investor, or the trades that were open at the time of investment in the investor's account will not be copied at all.

Freedom of action

The investor can invest or terminate investment in a managed account at any time without waiting for rollover.

The investor can invest from $10

Thanks to the ICE-MAM, it is possible to invest small amounts starting from $10

Note!

- Past performance does not guarantee future results. ICE Markets cannot guarantee your future results and/or success.

- ICE Markets provides only managed account service for investors and managers. The company is not a representative of any of the parties to trust management.

- ICE Markets does not participate in managing the funds of clients that are investing in managed accounts.

- Leveraged investing exposes an investor to higher risk and can lead to complete or partial loss of one's funds.

- If you do not fully understand the investment process or the degree of risk you may be exposed to, consult a third-party specialist for advice.

- The minimum amount required by a manager to open a managed account is $300.